check out your urlcheck over herebuying replica watchelf barhandyhüllen zum umhängenyocsn

Founded in 1965, Inapa Group occupies a leading position in the European paper distribution market and holds significant positions in packaging and visual communication distribution, with annual sales of 1000 million euros.

It is the only Portuguese company in the sector with an international presence and the only listed company in the paper distribution sector in Europe.

With a team of 1,652 employees, the Inapa Group operates in 10 countries - Germany, France, Spain, Portugal, Belgium, Luxembourg, Austria, the Netherlands, Turkey and Angola.

| Amounts expressed in millions of euros (except when specifically mentioned) | |||||

|---|---|---|---|---|---|

| Results demonstration | 2022 | 2021 | 2020 | 2019 | VAR. 22/21 |

| Tons('000) | 714 | 841 | 913 | 887 | -15,1% |

| Gross Margin | 523,8 | 415,8 | 386,5 | 387,4 | 386,5 |

| Sales | 1211,7 | 944,6 | 1015,5 | 1030,8 | 25,6% |

| Gross Margin | 242,7 | 179,3 | 185,5 | 178,4 | 35,4% |

| Gross Margin(%) | 20,0% | 18,6% | 18,3% | 17,3% | 1,4pp |

| Net Exploration Costs | 154,7 | 146,2 | 156,6 | 148,6 | 5,8% |

| Operating Income | 30,5 | 28,8 | 23,6 | 24,8 | 5,9% |

| Operating Costs | 185,2 | 175,0 | 180,2 | 173,4 | 5,8% |

| Impairment of current assets | 1,1 | 1,6 | 1,5 | 1,5 | -34,4% |

| Re-EBITDA | 86,9 | 31,5 | 27,4 | 28,3 | 176,3% |

| Re-EBITDA(%) | 7,2% | 3,3% | 2,7% | 2,7% | 3,9pp |

| Non recurrent costs | 10,8 | 0,7 | 11,6 | 1,6 | 10,2 |

| EBITDA | 76,1 | 30,8 | 15,8 | 26,7 | 147,0% |

| EBITDA(%) | 6,3% | 3,2% | 1,6% | 2,6% | 3,1pp |

| EBIT | 52,8 | 15,5 | -2,7 | 10,8 | 241,1% |

| EBIT(%) | 4,4% | 1,6% | -0,3% | 1,0% | 2,9pp |

| Net Financial function | 16,0 | 14,2 | 15,5 | 15,7 | 13,0% |

| EBT | 36,8 | 1,3 | -18,2 | -4,9 | 35,5 |

| Taxes on profits | -19,1 | 2,0 | 2,8 | 0,8 | -21,0 |

| Net Income | 17,8 | 3,3 | -15,5 | -4,1 | 14,4 |

| 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 | ||

|---|---|---|---|---|---|

| Net Debt | 221,1 | 261,8 | 315,0 | 337,3 | -15,6% |

| Net Debt / RE-EBITDA | 2,5 x | 8,3 x | 11,5 x | 11,9 x | -5,8 x |

| Net Debt excluding Trade Finance | 202,9 | 241,8 | 258,7 | 248,4 | -16,1% |

| Interest Coverage | 5,4 x | 2,2 x | 1,8 x | 1,8 x | 3,2 x |

| Working Capital | 35,8 | 11,4 | 73,0 | 87,6 | 215,1% |

Note: On 1 January 2019, the Inapa Group adopted the IFRS 16 accounting standard, opting for the modified retrospective transition model and did not restate the comparative financial information.

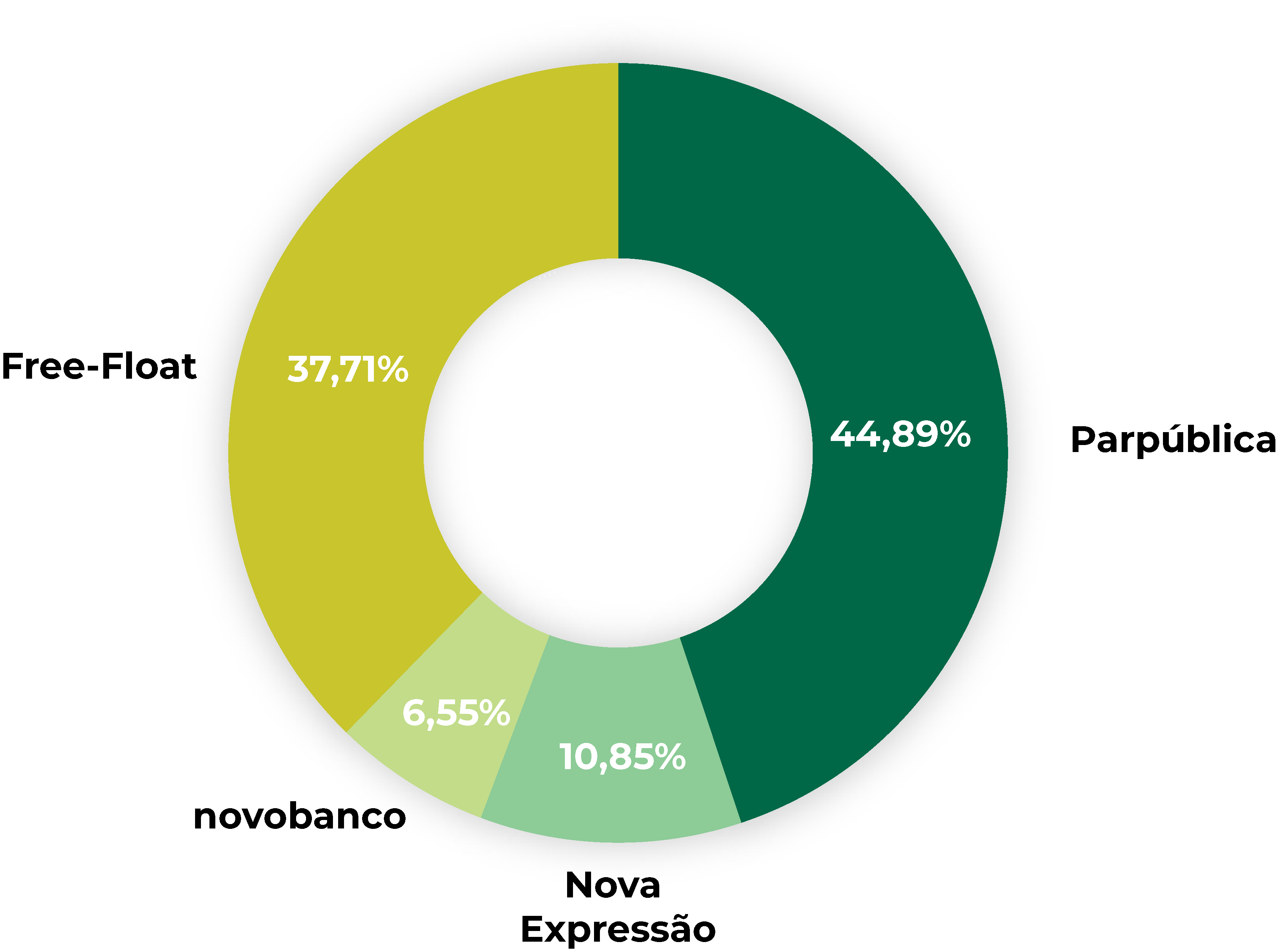

Inapa – Investimentos, Participações e Gestão, SA is a publicly-held company, listed on the Lisbon Stock Exchange (Euronext Lisbon) since 1980.

Ordinary Shares

Trading code: INA.LS

Código ISIN: PTINA0AP0008

Symbol: INA

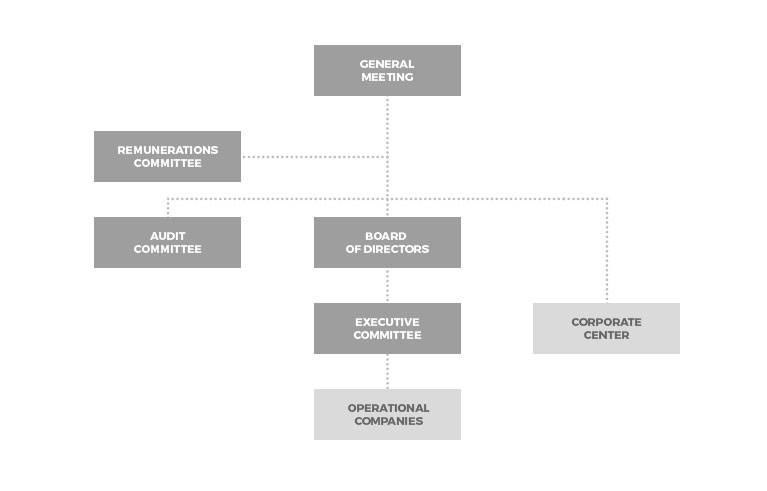

Several international publications have considered Inapa to be the best company in Portugal in the sphere of Corporate Governance for several years running. These distinctions recognize good corporate governance and the efforts made towards a better and more effective governance structure.

Chairman

Member of Board of Directors

Member of Board of Directors

Chairman

Member of Board of Directors

Member of Board of Directors

Member of Board of Directors

Member of Board of Directors

Member of Board of Directors

Member of Board of Directors

Member of Board of Directors

President

Member of Board of Auditors

Member of Board of Auditors

President

Secretary

President

| From |

To |

Miguel Loureiro - Investor Relations e Market Relations Representative

Rua Braamcamp, 40 – 9º Dto.

1250-050 LISBOA PORTUGAL(351) 213 823 007

(351) 213 823 016

Miguel.loureiro@inapa.pt

www.inapa.pt

To provide all investors - institutional or private - with the most complete and rigorous information, in strict compliance with the applicable legislation, on the corporate structure of the company and the group, on the rights and duties of the shareholders as they result from the law and the company's articles of association, on its economic and financial situation, according to the information disclosed and the forecast timetable of the most relevant events in the company's life.

To provide investors, in compliance with the applicable legal and regulatory framework, with any additional or complementary clarifications that may reasonably be requested and on the aforementioned information.